Experience the Future of Regulatory Technology

AQMetrics empowers you to navigate compliance and regulatory challenges with confidence, backed by award-winning technology.

AQMetrics empowers you to navigate compliance and regulatory challenges with confidence, backed by award-winning technology.

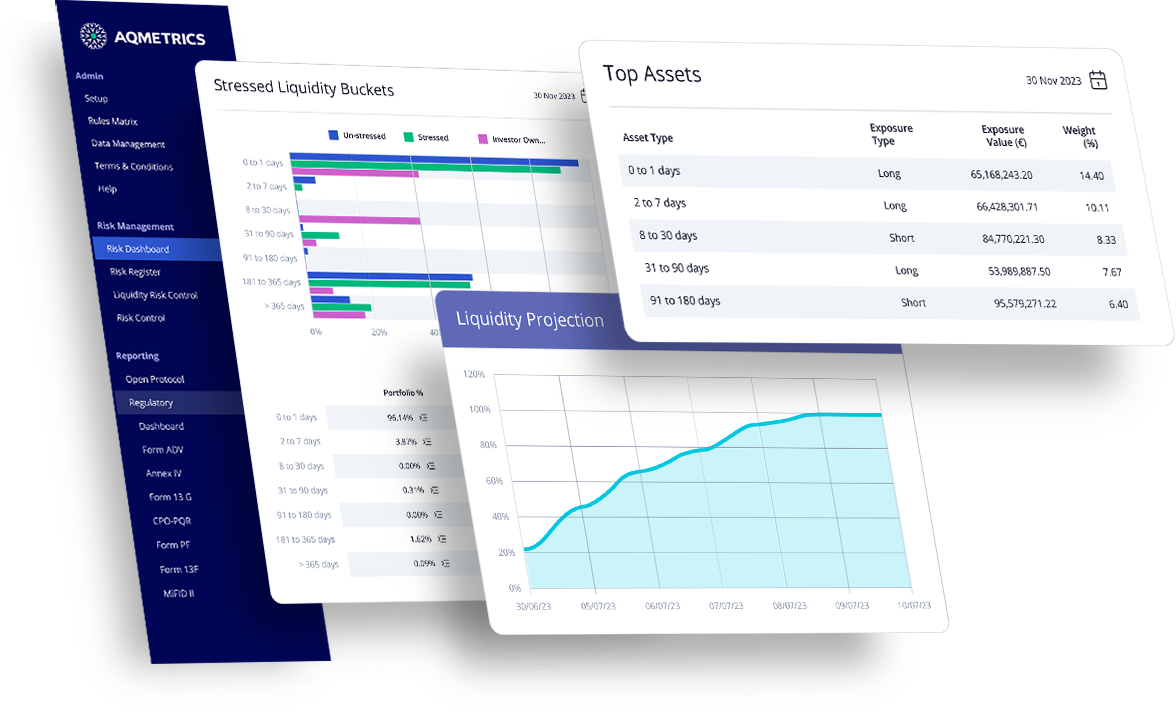

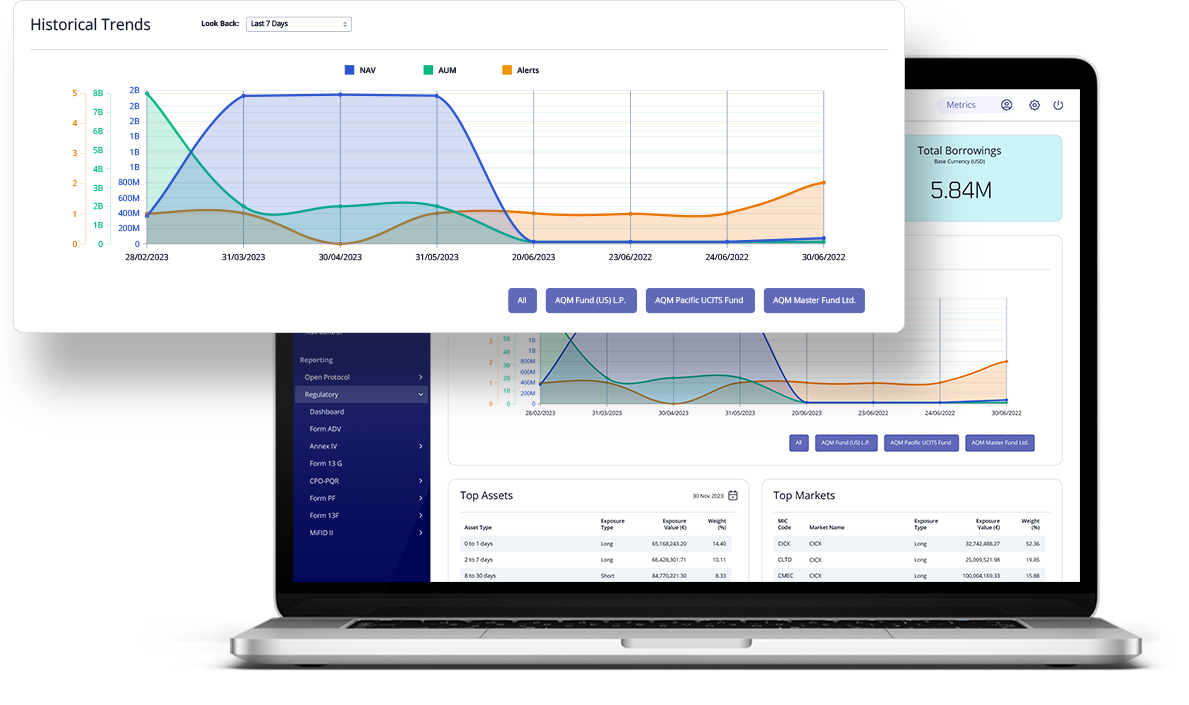

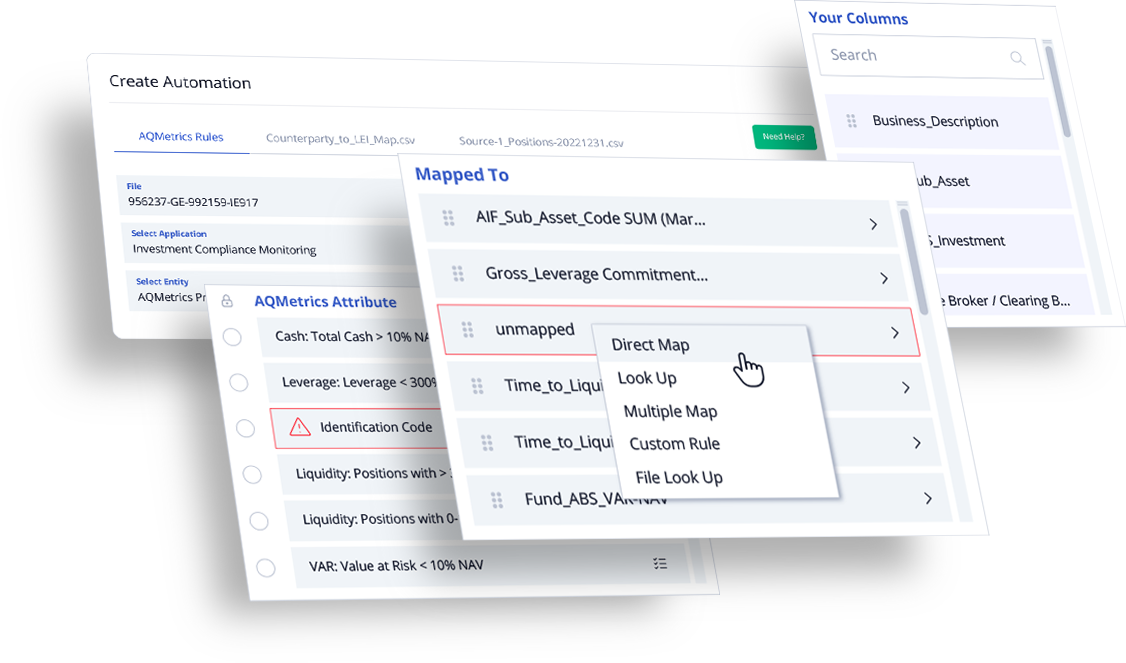

Harness the power of automation to optimise productivity, allowing your team to concentrate on core activities and strategic initiatives.

AQMetrics’ cloud-first regulatory technology ensures accuracy, precision, and reliability in compliance with regulations.

Our solutions ensure top financial institutions, from global banks to hedge funds, stay ahead of evolving regulatory landscapes.

AQMetrics’ award-winning technology is used by financial institutions worldwide. Our platform is known for its automated data management, user-friendly interface, and simplified approach to regulatory risk and compliance.

AQMetrics reports to the AFM, AMF, BaFIN, CBI, CNMV, CSSF, CFTC, CySEC, FCA, FIN-FSA, FSMA, NFA, SEC, Swedish Financial Supervisory Authority (Finansinspektionen), and the Danish Financial Authority.

AQMetrics is regulated as a Data Reporting Service Provider (DRSP). This means that AQMetrics is authorised and supervised by the pan-european regulator ESMA and the FCA in the UK. By being regulated, customers can be confident that AQMetrics is a robust organisation with solid governance structures and digital operation resilience at its core.

AQMetrics upholds the highest technical standards in its ICT systems, including ISO 27001. We ensure all ICT and digital operational resilience requirements align with existing and emerging standards and regulations through close collaboration with our customers.

AQMetrics operates globally, reaching clients across multiple jurisdictions. With offices strategically located in leading financial capitals such as London, New York, and Singapore, we extend our reach to key markets around the world.